I'm honored to again have been asked to speak before Minnesota bankruptcy attorneys at the annual bankruptcy institute, this time on the subject of avoiding common mistakes. Here is the brochure for the bankruptcy institute:...

Call Today For Your Consultation: 763-225-9583

When Legal Matters Become Personal

I'm honored to again have been asked to speak before Minnesota bankruptcy attorneys at the annual bankruptcy institute, this time on the subject of avoiding common mistakes. Here is the brochure for the bankruptcy institute:...

Payday loans often become a desperate consumer’s final lifeline to get by. But interest rates can actually exceed 100% per annum. A recent article discusses pending legislation in Minnesota to cap interest rates at “only” 36%. My experience is that payday lenders are...

A recent article indicated that there has been an 18% decrease in the amount of medical debts that are being reported on credit bureaus. This is due in part to new policies whereby medical debts under $500 are no longer being reported to the credit bureaus, nor are...

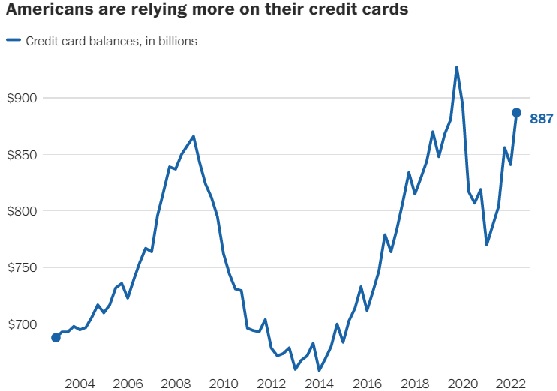

High inflation and rising interest rates have caused credit card balances in the US to increase to $931 billion as of year end 2022, according to the latest Credit Industry Insights report by TransUnion. Additionally, the number of new credit cards opened increased by...

Minn.Stat section 519.05 provides: A spouse is not liable to a creditor for any debts of the other spouse. Where husband and wife are living together, they shall be jointly and severally liable for necessary medical services that have been furnished to either spouse,...

A recent article in an online advice column, posed this question. The answer of course, is to just say no. Realistically, this woman needs to file bankruptcy, but if she was not eligible or able for whatever reason, the general rule is that old bad debt settles...

Department of Education to relax standard for Student Loan discharge in Bankruptcy. A recent press release indicates that the Department of Education is going to make it a lot easier for people who have, or will, file bankruptcy, in order to get rid of their student...

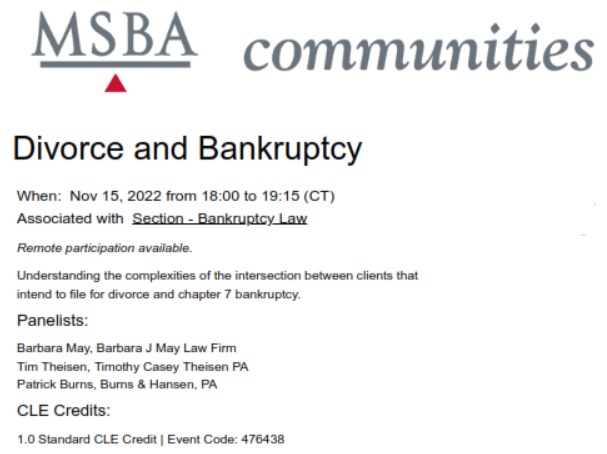

Tim Theisen joins a panel of distinguished speakers, before the Bankruptcy section of the MN Bar Association, on the topics of family law issues in bankruptcy.

The Department of Justice recently adjusted the median income figures, which are effective in bankruptcy cases filed after November 1, 2022. The median income is an important figure, as debtors below that figure are almost always assured a chapter 7 discharge. For...

With increased inflation, usually comes increased interest rates. Those who can least afford it, particularly credit card borrowers and people with fixed incomes, are most vulnerable to these rate changes. A recent Washington Post article mentioned that with all of...