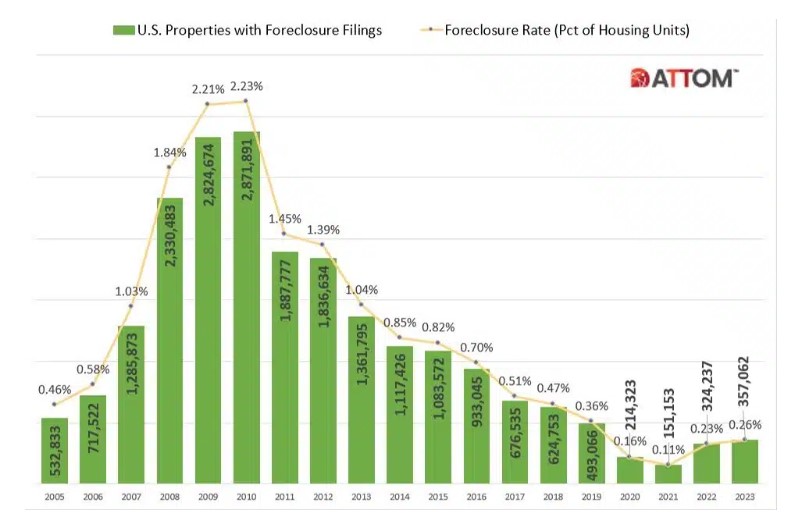

A recent Star Tribune article indicates that Minnesotans have an average of $63,000 of debt per capita (which includes mortgages). As a bankruptcy attorney, we definitely saw a lull with all of the moratoriums on student loans, garnishment, foreclosures and evictions,...