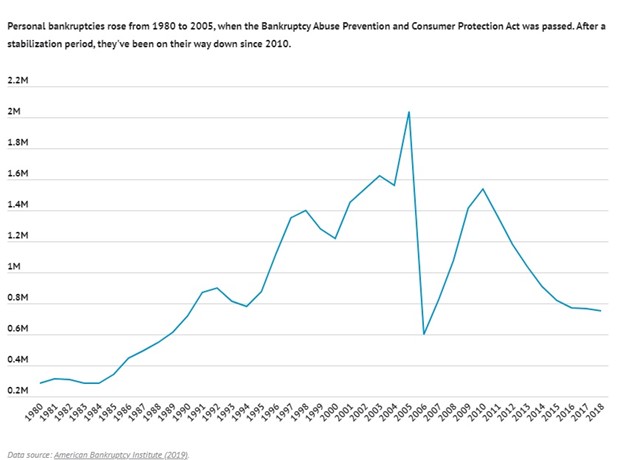

With record shattering unemployment due to the pandemic, a lot of people are surprised that 2020 bankruptcy filings to-date are down 30% from 2019; that figure includes commercial filings, and for individual bankruptcies, the numbers have decreased by at least 40%. For most of the 2010’s, bankruptcy filings have been around 750,000, and will likely be around 500,000 for 2020.

So why are filings down so much this year? I’ve got some theories. At first, it was the whole social distancing thing, as our clients (and our office) adjusted to meeting virtually instead of in person. We have certainly become accustomed to that, and I believe our clients have, and we also now have reopened the office for people who prefer in–person meetings.

The next most obvious reason for the decrease in filings, is the current moratorium on garnishments, evictions, and most foreclosures. I still have a tough time blaming the decrease on those factors though, because people who were facing those issues were probably less than 20% of my clients. And the $600 weekly bump too unemployment definitely helped a lot of people, although when that expired in August, we did not see the expected corresponding increase in filings.

My thought and experience is that personal finance is a stressor on people, and it is usually one of many stressors, in some days it is a high enough stressor for people to act on it, and other days, other stressors become more pressing. Combine that with all of the uncertainty, including the election, various proposals being bandied about in Congress, and the normal seasonal drop in filings over the Holidays, and I just don’t think bankruptcy has risen to the top of the stress list for a lot of people yet.

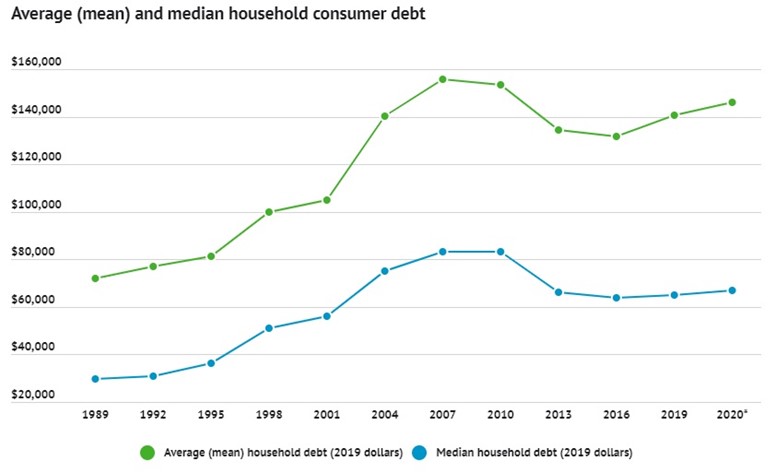

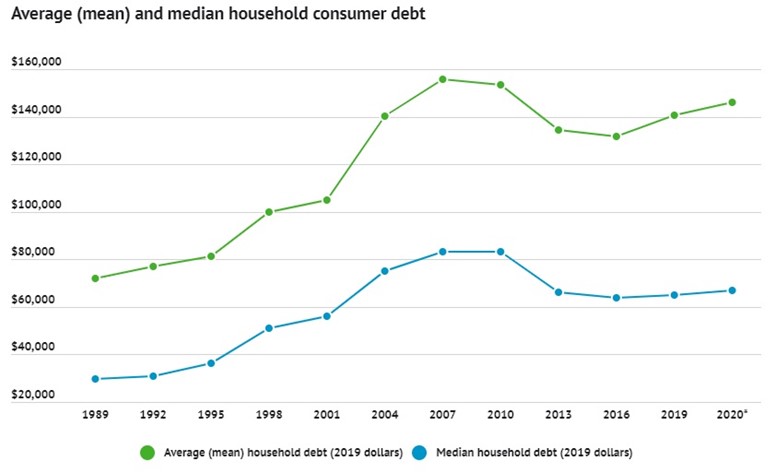

Savings has increased in 2020 as people are spending less at restaurants, travel and shopping. But that’s probably more indicative of the widening gulf between the haves and have–nots, as consumer debt has also increased this year:

What’s in store for 2021?

With increasing consumer debt, high rates of unemployment, and government benefits that will eventually need to expire, it stands to reason that the 250,000 or so people who were on track, statistically, to file bankruptcy 2020, will probably file in 2021, plus a whole lot more. Many are predicting a tsunami a bankruptcy filings, as moratoriums on evictions, garnishments, and foreclosures expire. Not to mention all of the landlords who have borne the burden of the eviction moratorium, who may be forced to file bankruptcy. In addition, we have seen many restaurants close down, plus other small shops, particularly salons and gyms, will not weather the storm, and will be forced to file in large part to get out of personal guarantees on long term commercial leases. And there have been many “successful” mortgage forbearance agreements where re-done escrows will put people in the red by increasing monthly payments by several hundred dollars, which can be resolved in a chapter 13.

With all of the governmental spending and shortfalls, it is also possible that state and federal tax rates may need to increase to pay for all of this. This has largely been accomplished by printing more money, which traditionally and theoretically should lead to inflation, all of which may add additional financial stressors on families trying to make ends meet.

Increased demand on bankruptcy attorneys, especially if inflation rears its ugly head, may result in increased fees for bankruptcy services. With today’s social distancing protocols, whereby meetings with a bankruptcy attorney, and bankruptcy trustee, are done virtually, a bankruptcy can safely be filed from the confines have your own home. If bankruptcy appears in your horizon, now may be a great time to file.