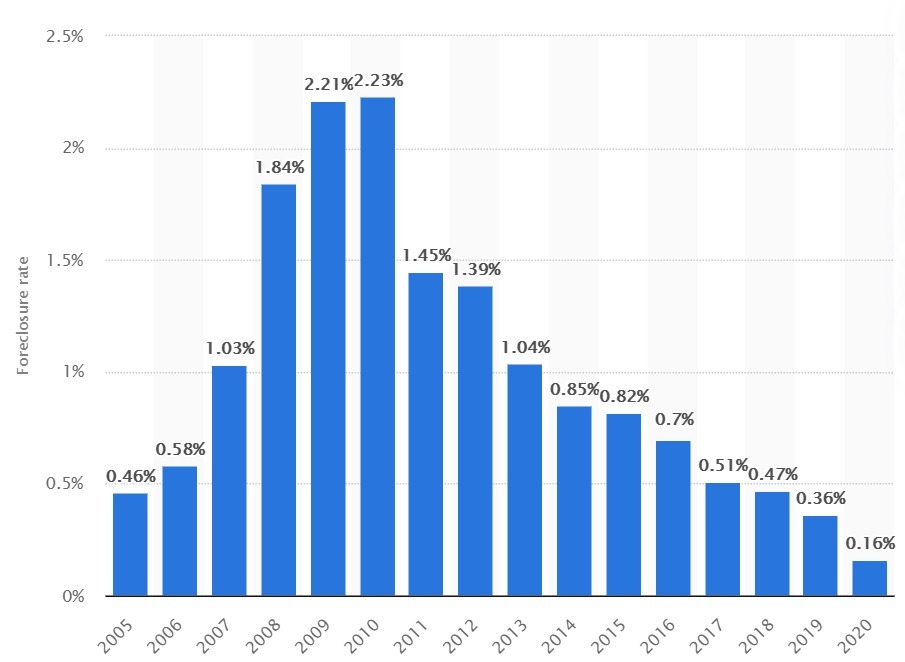

Foreclosure rates have continued to dwindle since they peaked in 2010. A recent article talked about reasons why there is not likely to be anywhere near the surge that we had experienced during the last recession. There are a few additional reasons that I have observed, why I believe this is true.

While the last peak of filings had been preceded by a run up of values like we have experienced in the last couple of years, the mortgage industry has tightened down and increased lending standards. There are a lot fewer exotic mortgages, and it is more difficult for investors to get multiple mortgages. we are also seeing a lot less exotic product such as arms which would adjust at super high rates, $0 down mortgages, 80-10-10 products, people dipping into home equity loans, nor do we see the so-called “ninja” loans that we used to see — no income, no jobs or assets.

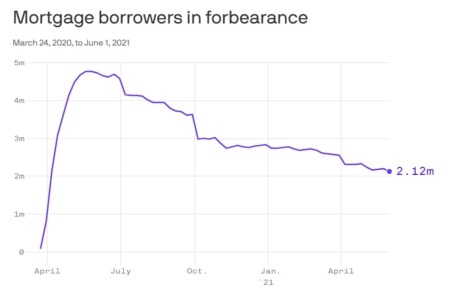

Also, loan modification markets, which was something that mortgage companies had to scramble to create 12 years ago, are now well refined, and are standard in the industry. So most people who are in trouble, can modify their mortgage two acceptable terms, often with lower interest rate, re amortized over up to 40 years, a portion of the principle deferred or sometimes even waived, an ultimately lower payments. In my opinion, it’s probably not a good practice for the market to let people continually modify their mortgages, so some mortgage companies will have a limit on how many modifications can be done within so many years, but with all of the federal mandates in place, most people are getting modifications.

Because I have seen more people carrying equity than I saw 12 years ago, if people do end up getting in trouble and not being able to modify or refinance, they have the option of selling. 10-12 years ago, when values were plummeting, buyers and investors were spooked because they didn’t know when or if we were going to hit the bottom of the market. At the time, real estate had never seen a yearly decrease in values in most people’s lifetime. Now people realize that real estate cannot continue to decrease in value and will eventually go back up.

The big wild card in all of this is interest rates, which have been at historic lows for over 15 years. I had predicted, 15 years ago, that it would be an increase in rates that would stall the housing market. I was wrong, it was all of the other factors above, none of which really seemed to be in place in 2021.